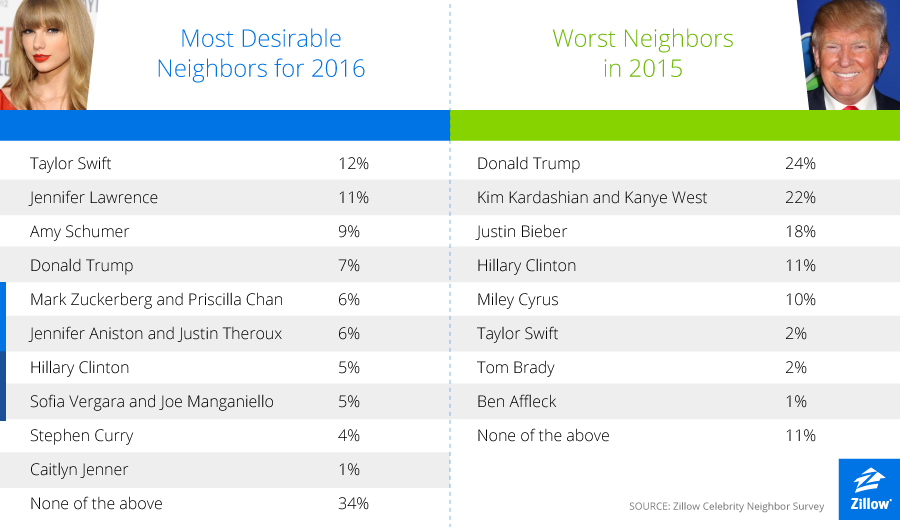

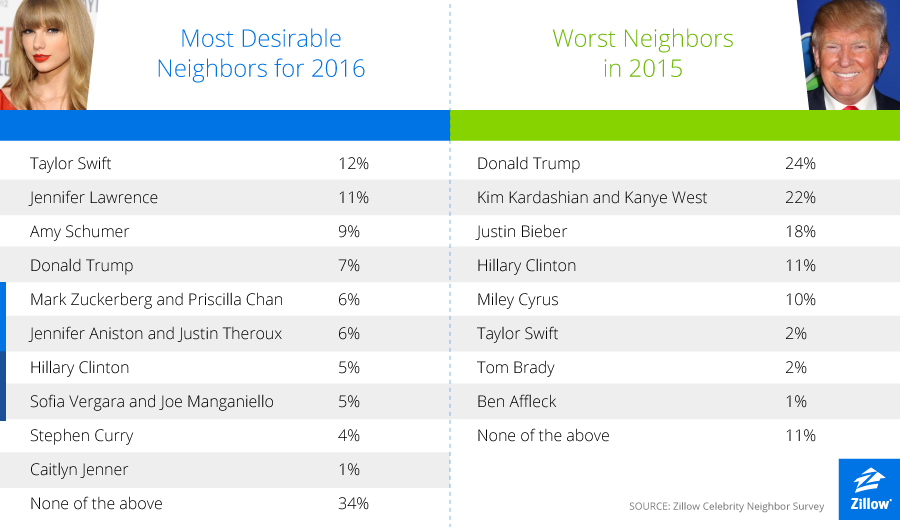

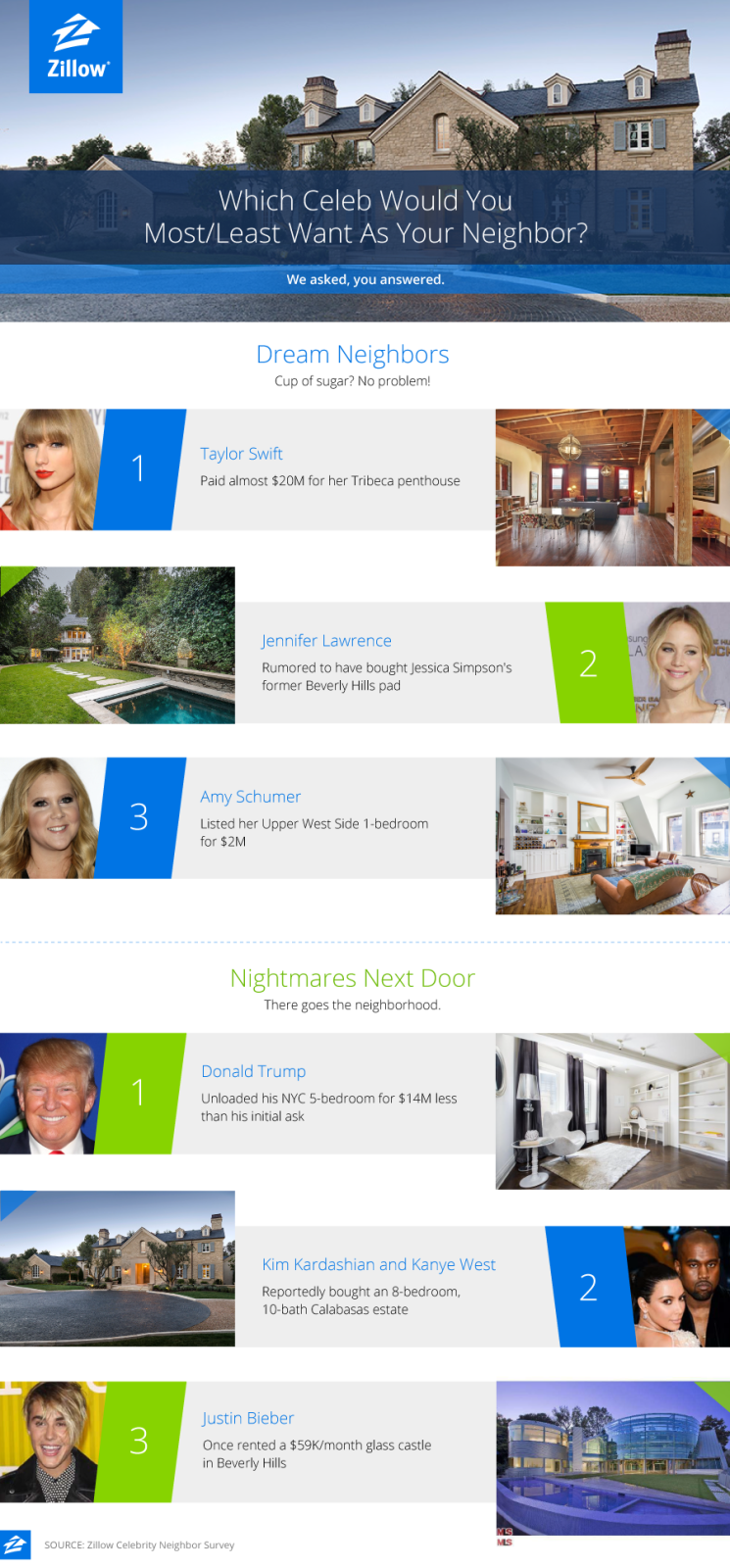

Every December, we ask Americans which celebrities they would most like to have as their neighbor, and which ones they’d hate to have next door. Here’s who respondents would be happy to call neighbor in 2016, and who they would have hated to live beside in 2015.

Most desirable neighbors for 2016

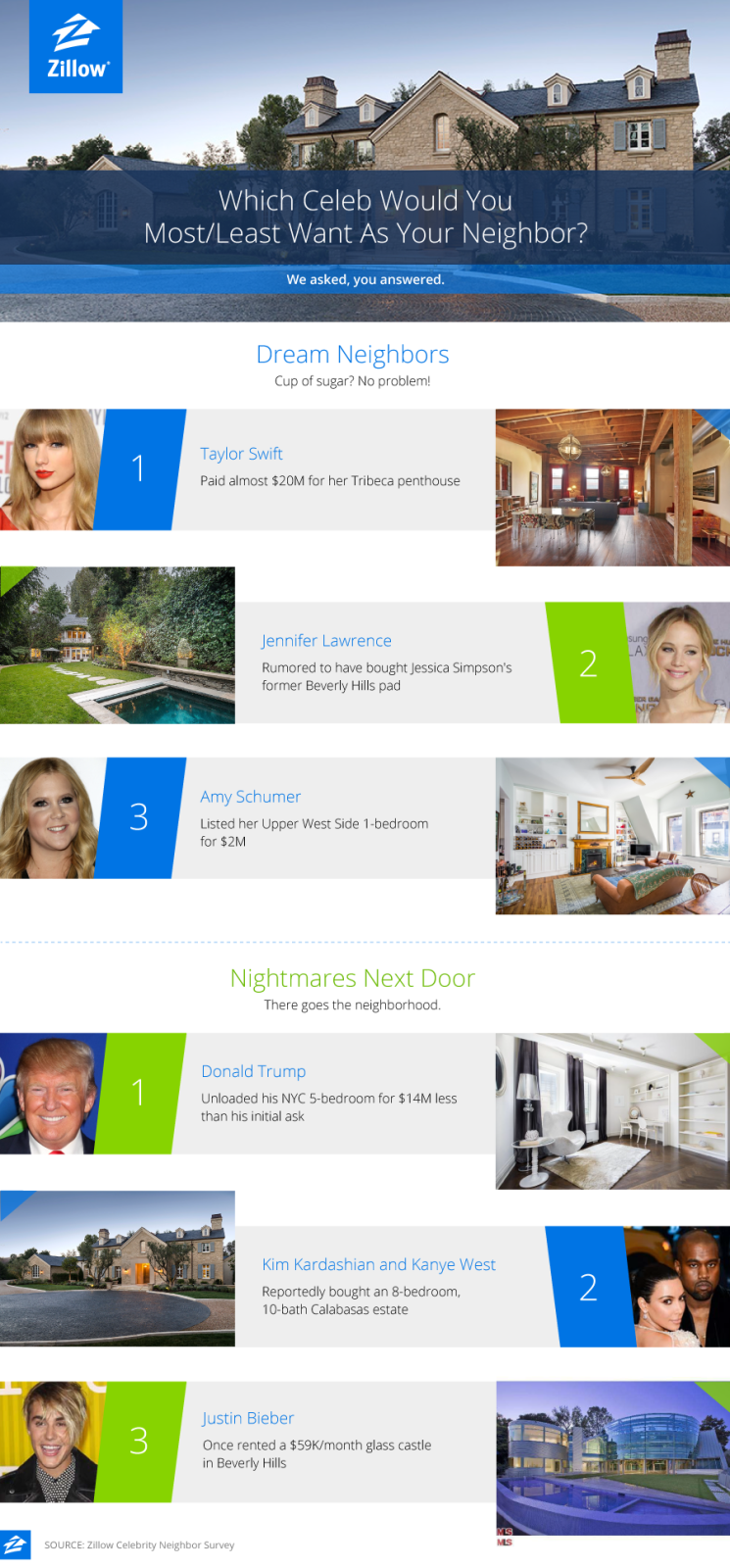

The kitchen in Taylor Swift’s Tribeca loft offers plenty of room to gather her squad.

On top of numerous other accomplishments this year, pop sensation Taylor Swift can now add Most Desirable Celebrity Neighbor to her growing awards list.

Swift was the top choice for a neighbor in 2016, earning 12 percent of votes. The pop star was especially favored among millennials, receiving 17 percent of their votes.

“2015 was a landmark year for Taylor Swift, from her highly successful 1989 World Tour, to being named the youngest female ever on Forbes’ 100 Most Powerful Women list, so it’s no surprise America picked the down-to-earth singer-songwriter as 2016’s most desirable neighbor,” says Jeremy Wacksman, Zillow chief marketing officer.

When she’s not touring or hanging out with glamorous friends around the world, Swift hangs her hat in the 7-bedroom, 5.5-bath Tribeca loft she purchased for nearly $20 million in October 2014.

Blockbuster star Jennifer Lawrence and comedian Amy Schumer rounded out the top three positions, earning 11 percent and nine percent of the votes, respectively. All three women were equally as popular among male and female voters.

Worst neighbors of 2015

Trump reportedly never lived in the NYC apartment he sold for $14M under his initial ask.

Outspoken Republican candidate Donald Trump tops this year’s list for worst neighbor, moving up three positions from his fourth-place finish in 2014. One in four voters (24 percent) say Trump is the worst neighbor of 2015 - nearly five times more than last year (five percent of votes).

Trump was especially disliked by females (27 percent) and millennials (33 percent) polled.

“Donald Trump is frequently in the limelight for his polarizing comments and non-apologetic attitude, which some may see as unattractive qualities in a neighbor,” says Wacksman.

In July 2015, Trump sold a nearly 6,200-square-foot apartment in the Trump Park Avenue tower for $21 million - significantly less than his original $35-million asking price.

Kim Kardashian and Kayne West came in second with 22 percent of the votes, narrowly defeating last year’s worst neighbor, Justin Bieber, who ranked third this year. Democratic presidential candidate Hillary Clinton finished fourth with 11 percent of the votes.

The complete survey results

Best/worst celebrity neighbor highlights

Which celebrities would most or least like to have next door?

Embed This Image On Your Site (copy code below):

from Zillow Porchlight | Real Estate News, Advice and Inspiration

http://www.zillow.com/blog/celebrity-neighbor-2016-189999/